dawn@lc.dawnobrien.com

DISCUSS YOUR FINANCIAL GOALS TODAY

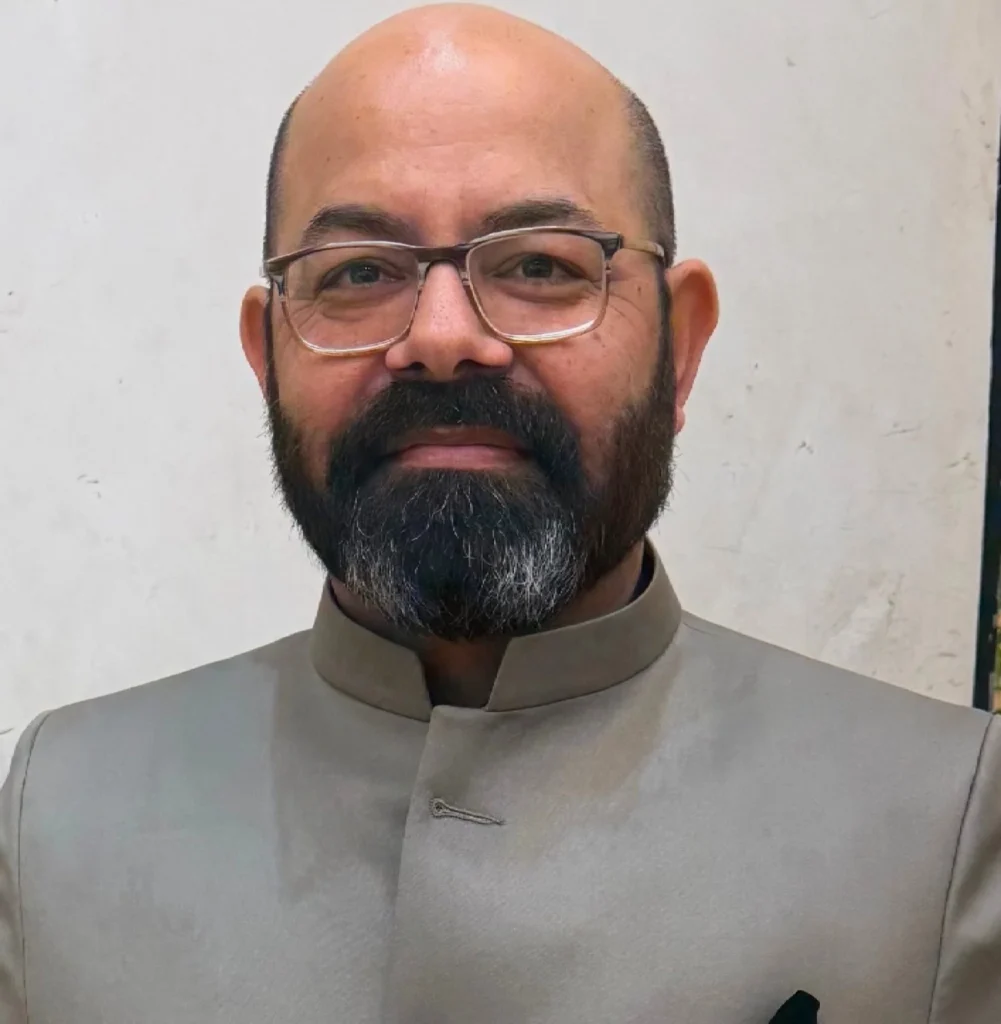

After more than two decades in the finance industry, I founded Rev Up Your Wealth & Co. to provide heart-centered, educational guidance rooted in clarity and trust.

Over the years, I saw too many people unsure about their financial future—not because they weren’t capable, but because they lacked clarity. That experience shaped my commitment to education and empowerment.

Today, while financial strategies remain core to my work, my mission has expanded to helping people think differently, challenge outdated systems, and create lives built on purpose, choice, and legacy.

This is about more than money.

It’s about living intentionally—at every stage.

After more than two decades in the finance industry, I founded Rev Up Your Wealth & Co. with a simple but deeply personal goal: to provide genuine, heart-centered guidance in an industry that too often feels confusing or transactional.

My work has always been grounded in empathy, transparency, and education. Over the years, I noticed a consistent pattern—many hardworking people didn’t truly understand their portfolios or retirement plans. They weren’t sure when they could realistically retire, how much insurance coverage they needed, what their Financial Independence Number was, or how taxes and market conditions could impact their future.

That realization shaped my approach.

I adopted an educational model of financial guidance rooted in collaboration and due diligence. I work with multiple companies so clients understand their full range of options—not because of a product agenda, but because empowerment requires clarity.

While financial strategy remains foundational, my vision expanded significantly in 2025. Through meaningful conversations and lived experiences, I came to understand that empowerment doesn’t stop with finances.

Too many people feel stuck in systems that no longer serve them—sometimes well into their 60s and beyond. That’s why, in 2026, Rev Up Your Wealth & Co. is focused on empowering people to think differently, challenge outdated paths, and design lives rooted in purpose, choice, and legacy.

This is about more than retirement planning.

It’s about clarity, freedom, and intentional living.

At Rev Up Your Wealth & Co., we believe:

We Do What's Best for You—Now and Always.

No jargon. Just simple, effective strategies.

Secure income that supports the life you’ve earned.

We’re not looking for everyone.

We’re calling in purpose-driven individuals who believe in empowering others, thinking differently, and building something meaningful.

If you value education, integrity, and impact—and feel called to help people gain clarity and confidence—there may be a place for you here.

This isn’t about fitting into a system.

It’s about creating something better—together.

I help individuals and business owners optimize taxes. What most people don't understand is that proper education is the key. Many believe that math equals money, but that’s not the case. Too often, individuals feel pressured to chase high rates of return. The real question is: should you focus on maximizing returns, or should you be prioritizing guaranteed income for a secure retirement?

Indexed annuities are retirement products designed to safely grow your savings. You enjoy growth linked to market performance, without the risk of losing your principal—even in a market crash. They’re ideal if you seek guaranteed lifetime income and peace of mind.

My strategies are ideal if you're nearing retirement, seeking protection from market risk, and want reliable income for life. If you're tired of market uncertainty and confusing financial jargon, I’m here to simplify your path to retirement.

Yes, your initial 30-minute consultation is completely free—no strings attached. It’s simply a chance for us to get to know each other, discuss your goals, and explore if my strategies align with your vision for retirement.

Yes, I recommend and offer products such as indexed annuities, life insurance with living benefits, and final expense insurance—solutions carefully selected to safeguard your retirement. My advice is personalized, transparent, and aligned with your best interests.

Yes. While indexed annuities are designed for long-term stability, most allow partial withdrawals each year without penalties. I’ll help you choose the right annuity to balance your need for growth, safety, and liquidity.

"Tax-free retirement" refers to using specific insurance products designed under IRS guidelines to create income streams that aren’t taxed as ordinary income. It’s a powerful way to protect your savings from future tax hikes and keep more of your hard-earned money.

Most financial institutions emphasize traditional approaches like 401(k)s and IRAs. My strategies include indexed strategies that the banks and wealthy have utilized for decades. A financial professional will show you how an average return compares to an actual return.

No. With an indexed annuity, your money isn't directly invested in the market, so if the market goes down, your principal stays protected. You won't earn interest during those downturns, but importantly, you won’t lose any of your hard-earned money. It’s a way to participate in market gains without risking your nest egg when things get rocky.

Rule #1: Never lose money.

Rule #2: Never forget Rule #1.

Buffett emphasizes protecting your investments from significant losses as the key to long-term financial success. This aligns perfectly with our philosophy at Rev Up Your Wealth—prioritizing safe, steady growth without risking your nest egg to volatile markets.