dawn@lc.dawnobrien.com

DISCUSS YOUR FINANCIAL GOALS TODAY

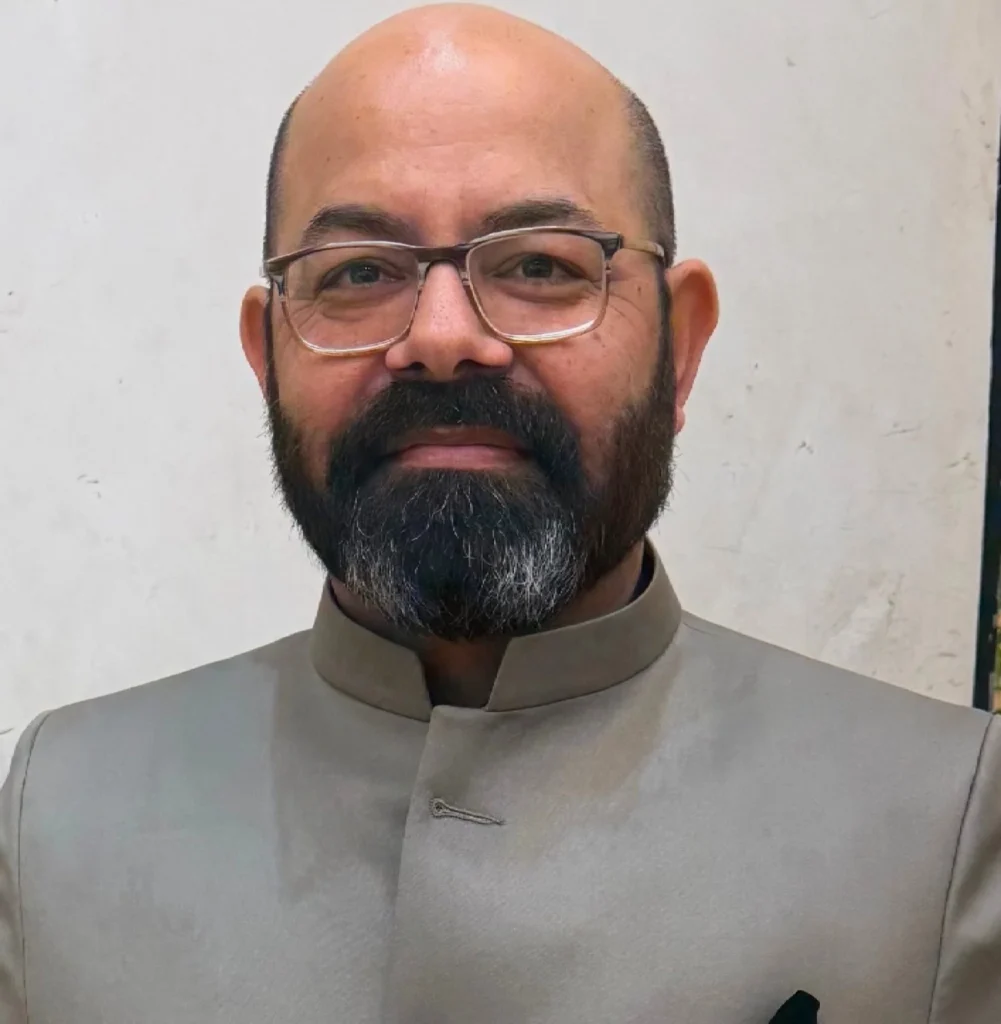

I’ve spent the last 28 years in the United States after immigrating from India, building a career in the retail industry where I worked as a salesperson and manager for nearly 25 years. Throughout that time, I focused on providing for my family and creating a stable life. But despite professional success, I had a wake-up call—I realized I wasn’t truly prepared financially.

That moment led me on a journey of self-education in financial literacy. At first, I was skeptical, but as I began to learn, I quickly realized how critical this knowledge is—not just for me, but for everyone. I fell in love with what I was discovering and wished I had learned it 25 years earlier.

Today, I’m passionate about sharing the importance of financial literacy with others, especially within immigrant communities. So many people are working hard, yet missing key tools to build lasting financial security. My mission is to help bridge that gap and empower others with the financial education I wish I had earlier in life.

Hi, I’m Maritza Santiago! As a dedicated entrepreneur with many years of business experience, I’ve always been passionate about empowering others. Last year, I had the incredible opportunity to connect with Dawn and became one of her clients. That experience opened my eyes to the transformative power of financial education.

Inspired by Dawn’s approach, I am now committed to helping individuals navigate their financial journeys. I understand that many people lack essential knowledge about finance, and I want to change that, especially within the Latino community.

Through my work, I strive to guide others toward financial independence and share the valuable insights I’ve gained along the way. Join me on this mission to rev up your wealth and unlock your financial potential!

We’re not looking for everyone.

We’re calling in purpose-driven individuals who believe in empowering others, thinking differently, and building something meaningful.

If you value education, integrity, and impact—and feel called to help people gain clarity and confidence—there may be a place for you here.

This isn’t about fitting into a system.

It’s about creating something better—together.

I help individuals and families build secure, stress-free retirements. Whether you're worried about market crashes, outliving your savings, or tax burdens, I guide you through clear, safe strategies like indexed annuities, living benefits, and tax-free retirement solutions.

Indexed annuities are retirement products designed to safely grow your savings. You enjoy growth linked to market performance, without the risk of losing your principal—even in a market crash. They’re ideal if you seek guaranteed lifetime income and peace of mind.

My strategies are ideal if you're nearing retirement, seeking protection from market risk, and want reliable income for life. If you're tired of market uncertainty and confusing financial jargon, I’m here to simplify your path to retirement.

Yes, your initial 30-minute consultation is completely free—no strings attached. It’s simply a chance for us to get to know each other, discuss your goals, and explore if my strategies align with your vision for retirement.

Yes, I recommend and offer products such as indexed annuities, life insurance with living benefits, and final expense insurance—solutions carefully selected to safeguard your retirement. My advice is personalized, transparent, and aligned with your best interests.

Yes. While indexed annuities are designed for long-term stability, most allow partial withdrawals each year without penalties. I’ll help you choose the right annuity to balance your need for growth, safety, and liquidity.

"Tax-free retirement" refers to using specific insurance products designed under IRS guidelines to create income streams that aren’t taxed as ordinary income. It’s a powerful way to protect your savings from future tax hikes and keep more of your hard-earned money.

Most financial institutions emphasize traditional approaches like 401(k)s and IRAs. My strategies, including indexed annuities and living benefits, provide safe alternatives that banks and the wealthy have utilized for decades—now I bring these options to you.